Mutual Funds Investment

Deciding whether to invest in mutual funds depends on your financial goals, risk tolerance, and investment horizon. Here are some factors to consider when making an investment decision:

Financial Goals: Start by defining your financial goals. Are you investing for retirement, buying a home, funding your child's education, or just looking for a way to grow your wealth? Your goals will influence your investment strategy.

Risk Tolerance: Consider how comfortable you are with risk. Mutual funds come in various types, some with higher risks and potentially higher returns, while others are more conservative. Choose funds that align with your risk tolerance.

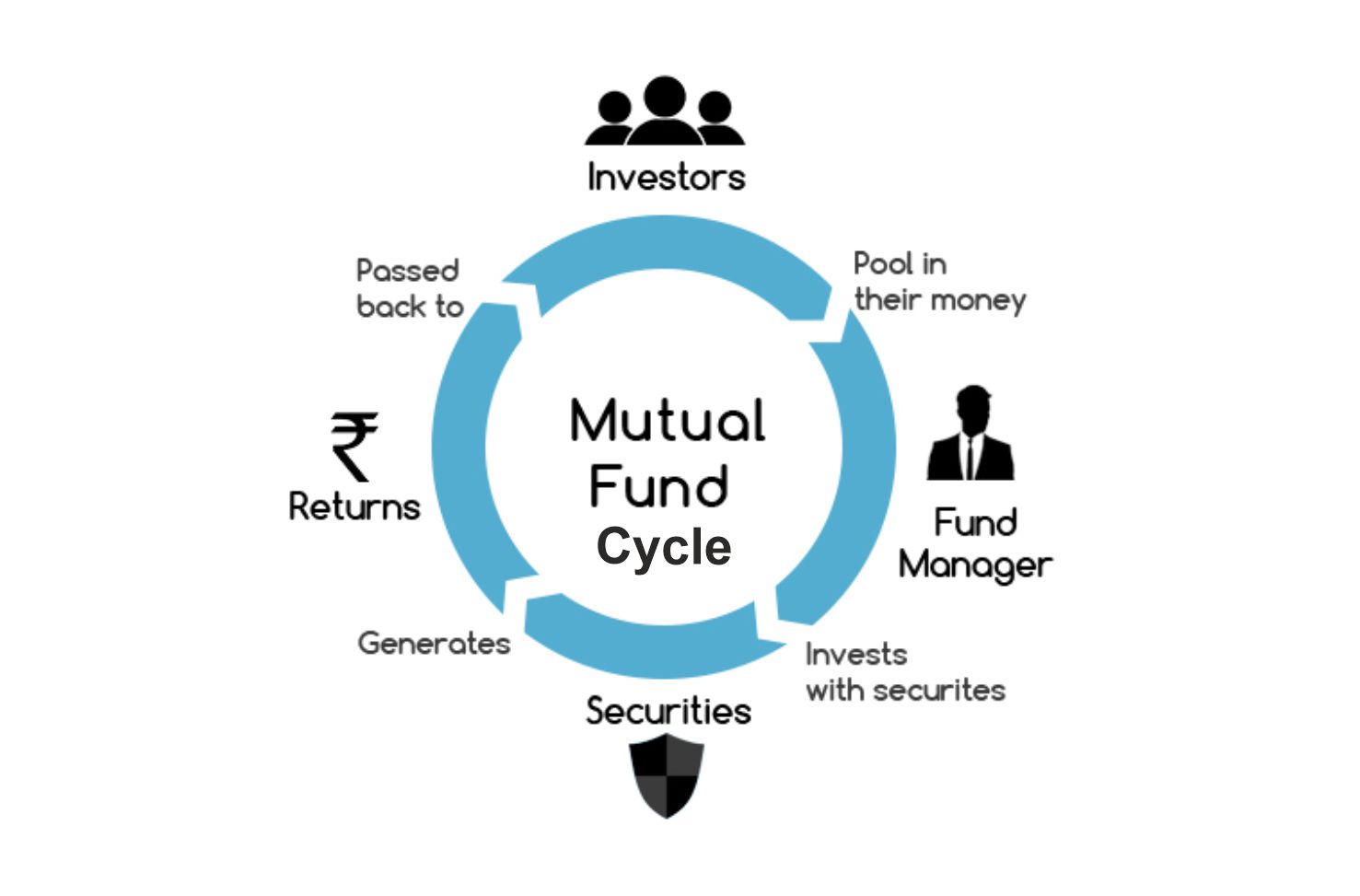

Diversification: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Diversification can help spread risk and reduce the impact of a poor-performing investment.

Investment Horizon: Your investment horizon, or how long you plan to keep your money invested, is a crucial factor. Longer horizons often allow for more risk-taking and the potential for higher returns.

Costs: Be aware of the costs associated with mutual funds, including expense ratios and any sales charges or commissions. Lower-cost funds can result in higher net returns.

Historical Performance: While past performance doesn't guarantee future results, it can provide insights into how a fund has performed under different market conditions. Analyze a fund's historical returns and consistency.

Investment Style: Different mutual funds have different investment styles, such as growth, value, income, or index tracking. Choose funds that match your investment objectives.

Professional Management: One of the benefits of mutual funds is that they are professionally managed by fund managers who make investment decisions on your behalf. Research the fund manager's track record and strategy.

Liquidity: Mutual funds are typically liquid investments, meaning you can buy or sell them daily. Ensure that you have easy access to your money when needed.

Tax Considerations: Be aware of the tax implications of your investments. Mutual funds can generate capital gains and income that may be taxable. You may want to consider tax-efficient funds for your portfolio.

Regular Monitoring: Regularly review your investment portfolio to ensure it aligns with your goals and risk tolerance. Adjust your investments as needed.

Before investing in mutual funds, it's often a good idea to consult with a financial advisor or do thorough research to make informed decisions. Diversifying your investments across a variety of asset classes and types of mutual funds can help you manage risk and work towards your financial goals.

The BharatBiz

The BharatBiz

5112

5112

16

16